Author: Mohamed Noordeen - Head of Tax & Accounting Uploaded: April 24, 2024 Last Updated: June 21, 2024

The United Arab Emirates (UAE) has introduced Corporate Tax (CT) law effective for financial years starting on or after June 1, 2023. The headline tax rate is nine percent (9%); however, taxable income up to AED 375,000 (roughly US$ 100,000) will be taxed at zero percent (0%).

Applicability of the CT Law on International Business

CT is applicable for all businesses and individuals carrying out business activities. This broadens the tax base to include all conducting commercial activities, irrespective of their legal form or place of incorporation.

Calculation of Taxable Profits for International Business

Accounting income as per the International Financial Reporting Standard (IFRS) is the basis for determining taxable profits. Tax is calculated on the taxable profits as follows:

- Zero percent (0%) on the portion of the taxable profit not exceeding AED 375,000

- Nine percent (9%) of the portion of the taxable profit exceeding AED 375,000

- Qualifying Free Zone Person (QFZP) is eligible for a 0% Corporate Tax rate on its qualifying income.

Exemptions and Exceptions for International Business

Several exemptions are provided within the Corporate Tax regime. The following exemptions are included:

- Domestic dividends

- Dividends and other profit distributions received from foreign juridical persons if the recipient has a participating interest in the foreign company

- Participation exemption for other income and gains

- Foreign permanent establishment exemption

- Income from operating aircraft or ships in international transportation

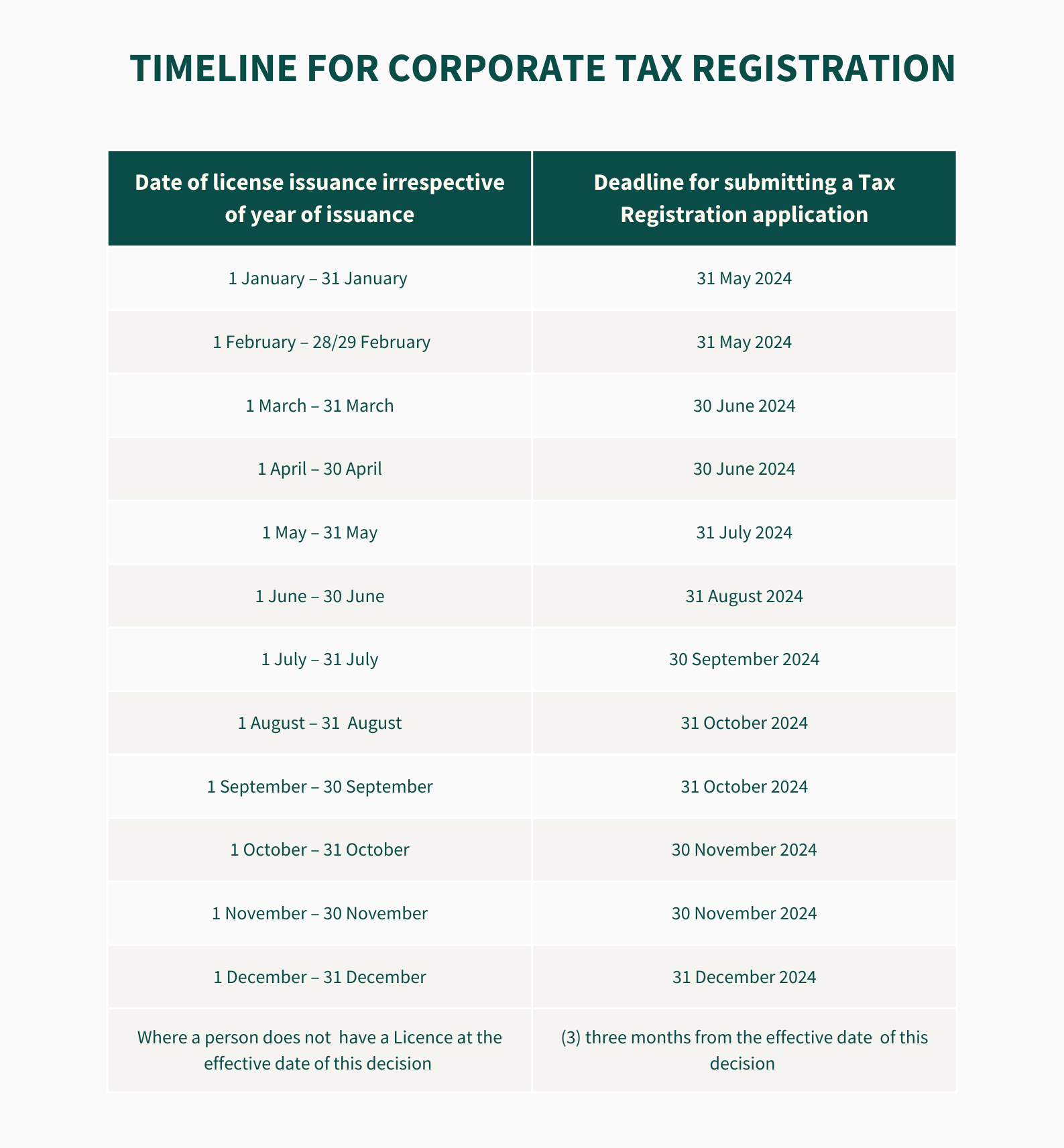

Important Dates For UAE Corporate Tax Registration

The FTA has recently announced the deadlines for corporate tax registration. Existing businesses must register within the timeline as below:

A few other points to consider include:

- New businesses must register within 3 months of incorporation. Late registration could result in a penalty of AED 10,000.

- Additionally, businesses must file the tax return and pay it within nine months following the completion of their financial year. Administrative penalties could be a result of late filing or payment.

- Taxable persons should maintain records and documentation that support the information provided in a tax return. These records and documents must be kept for seven years following the end of the tax period to which they relate.

Various Strategies for International Business to Overcome the Change in Tax Regime

- Double Taxation Agreements (DTA) between the UAE and other countries will generally provide for methods to eliminate double taxation. If a resident person derives foreign source income from a country with which the UAE has a DTA in place, the international business must review their areas of operations to determine how they are impacted by the DTA. Tax planning strategies should accordingly be structured around this.

- Another area of consideration are the distributions received from foreign juridical persons. They are exempt from the UAE corporate tax if the recipient has a participating interest in the foreign company. So, this is an area that would require a detailed review by international businesses.

- To calculate the taxable income, businesses that prepare their financial statements using the accrual basis of accounting may elect to account for gains and losses on a realisation basis. This would enable the businesses to exclude the unrealised gains or losses on the non-financial asset. Upon realisation of the asset or liability, the taxable person will need to include any amounts that were not previously considered for corporate tax purposes as a result of the adjustments mentioned above. Tax planning would be an important consideration here, as the election is made during the first tax period and cannot be changed except with the approval of the Federal Tax Authority (FTA).

- The determination of residence for corporate tax purposes will consider whether the juridical person incorporated or otherwise recognised in a foreign jurisdiction is effectively managed and controlled in the UAE.

Key Corporate Tax Areas to Be Focused on by International Business in the UAE

- Reviewing accounting policies to be consistent with IFRS would be the foremost requirement. The existing accounting system may need to be adjusted to cater to this requirement.

- Transfer pricing rules are to ensure the price of a transaction is not influenced by the relationship between the parties involved. The recognised arm’s length principle is used for transactions between related parties and connected persons. The transfer pricing rules apply to both cross-border and domestic transactions carried out by juridical persons and individuals.

- The introduction of Base Erosion Profit Shifting (BEPS) pillar 2 of the global minimum tax would be applicable to multinational groups once this is implemented.

Conclusion

-

The UAE’s implementation of corporate tax marks a significant shift in the business landscape. While there are adjustments to navigate, the new regime offers a pathway for long-term stability and growth.

Corporate taxes for the international business will require detailed planning across all its decisions, whether its place of management, double taxation impact, dividends, interests, etc. By understanding the key regulations, potential benefits, and available resources, international businesses can confidently adapt and thrive in the evolving UAE market. Gatestone Group stands ready to be your trusted partner, providing expert guidance and support throughout your UAE tax journey.